tax deferred exchange definition

Is determined by expansive definition of like-kind similar to. Tax Compliance Agreement means the Federal Tax Certificate Tax Compliance Agreement Arbitrage Agreement or other written.

6 Steps To Understanding 1031 Exchange Rules Stessa

Adjective not taxed until sometime in the future.

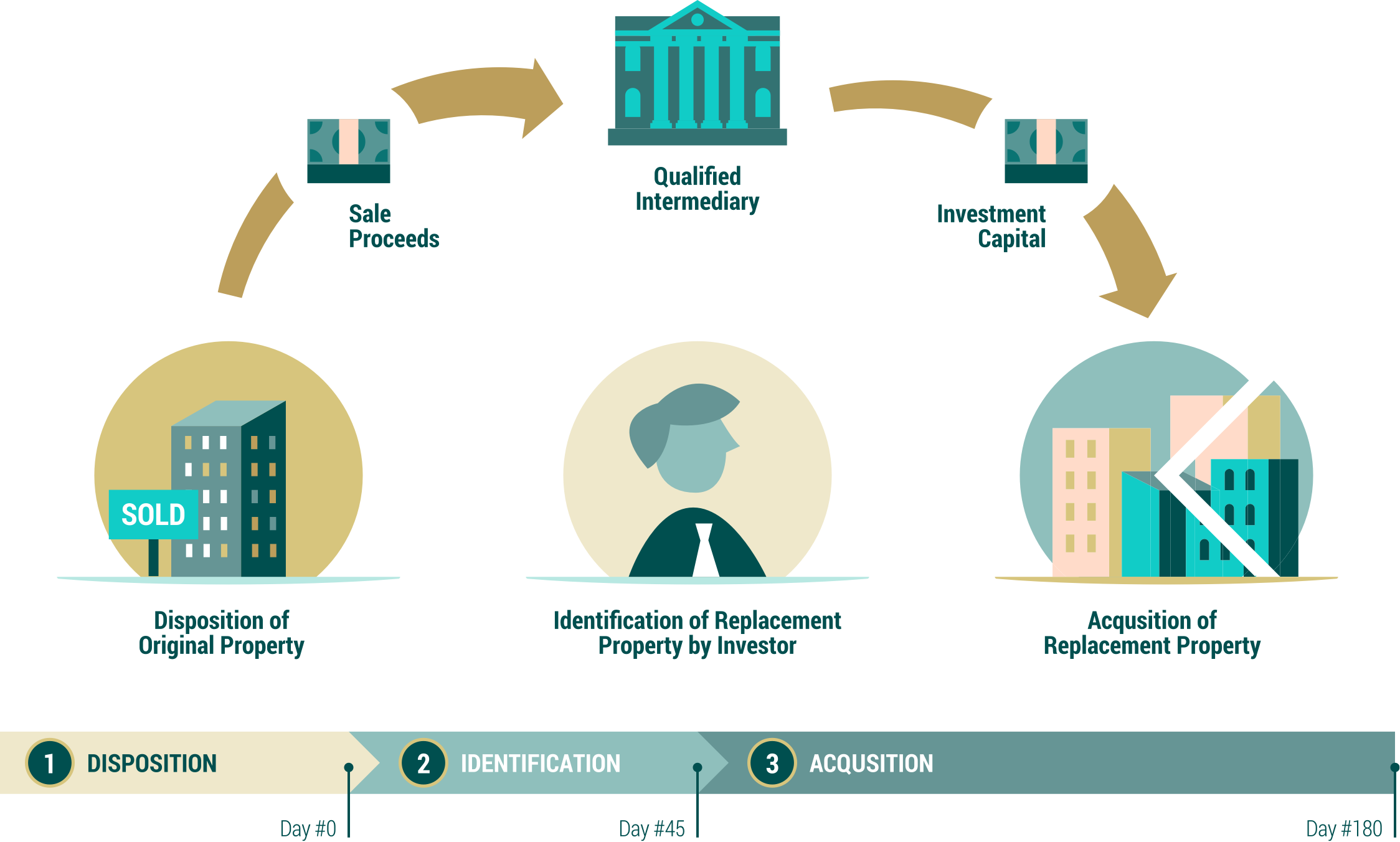

. Ask the team of 1033 tax-deferred exchange specialists at Exeter 1031 Exchange Services LLC and we WILL get you an answer. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar. Tax-deferred exchanges cannot be used for personal-use properties and under new laws enacted in December 2017 only real property qualifies for a 1031 exchange.

Tax Deferred Exchange is defined in Section 125. The companys Sponsor KB Exchange Trust structures commercial real estate offerings as DSTs a separate legal entity that qualifies under Section 1031 as a tax-deferred exchange. Define Headquarters Property Tax Deferred Exchange.

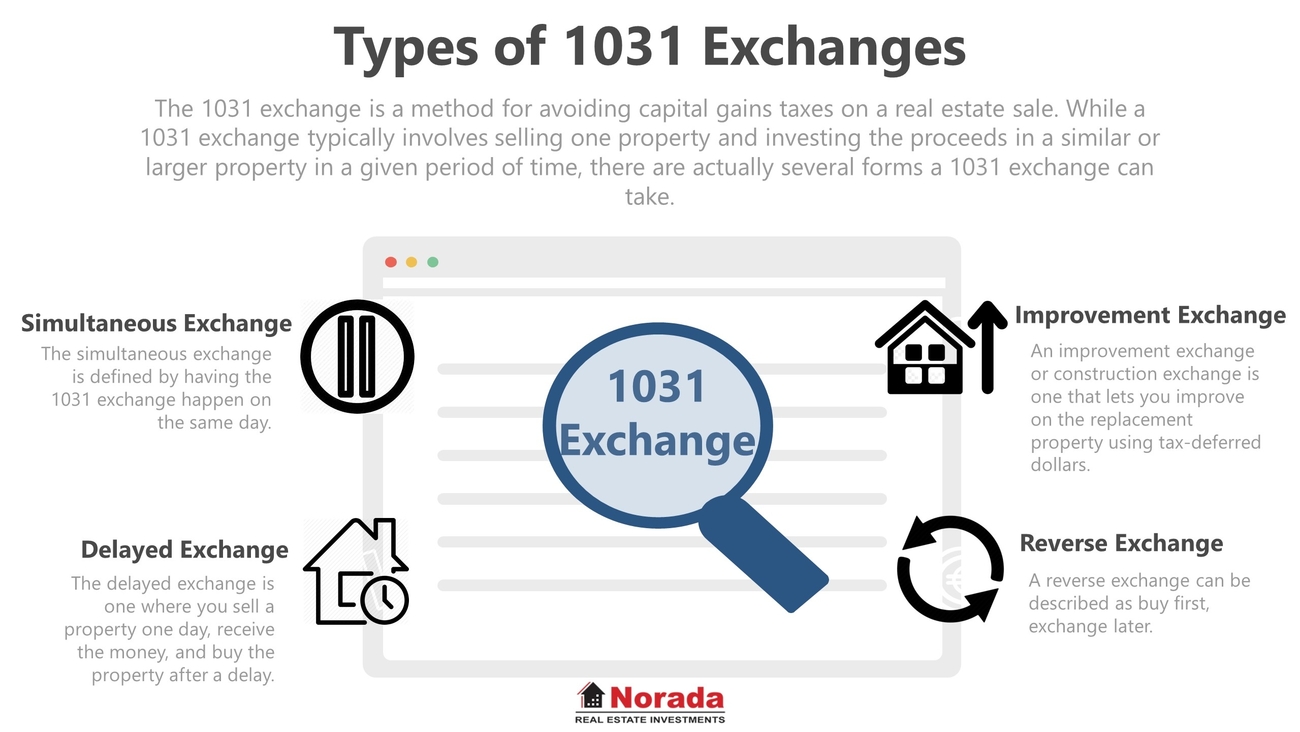

Related to Reverse Tax-Deferred Exchange. The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property. Internal Revenue Service Code that allows investors to defer capital gains taxes on any exchange of like-kind properties for business or.

The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes. Taxable Wage Base means with respect to any Plan Year the.

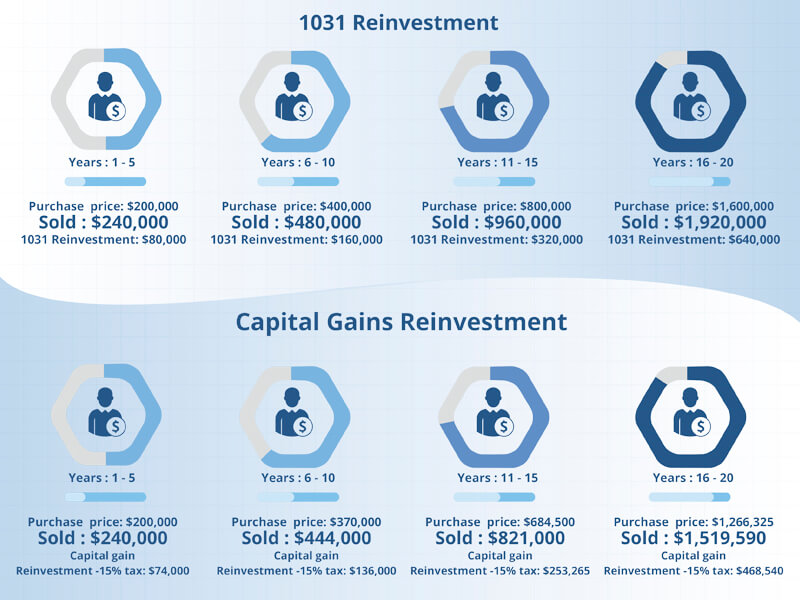

Those taxes could run as high as 15. Base Tax Year means the property tax levy year used. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes.

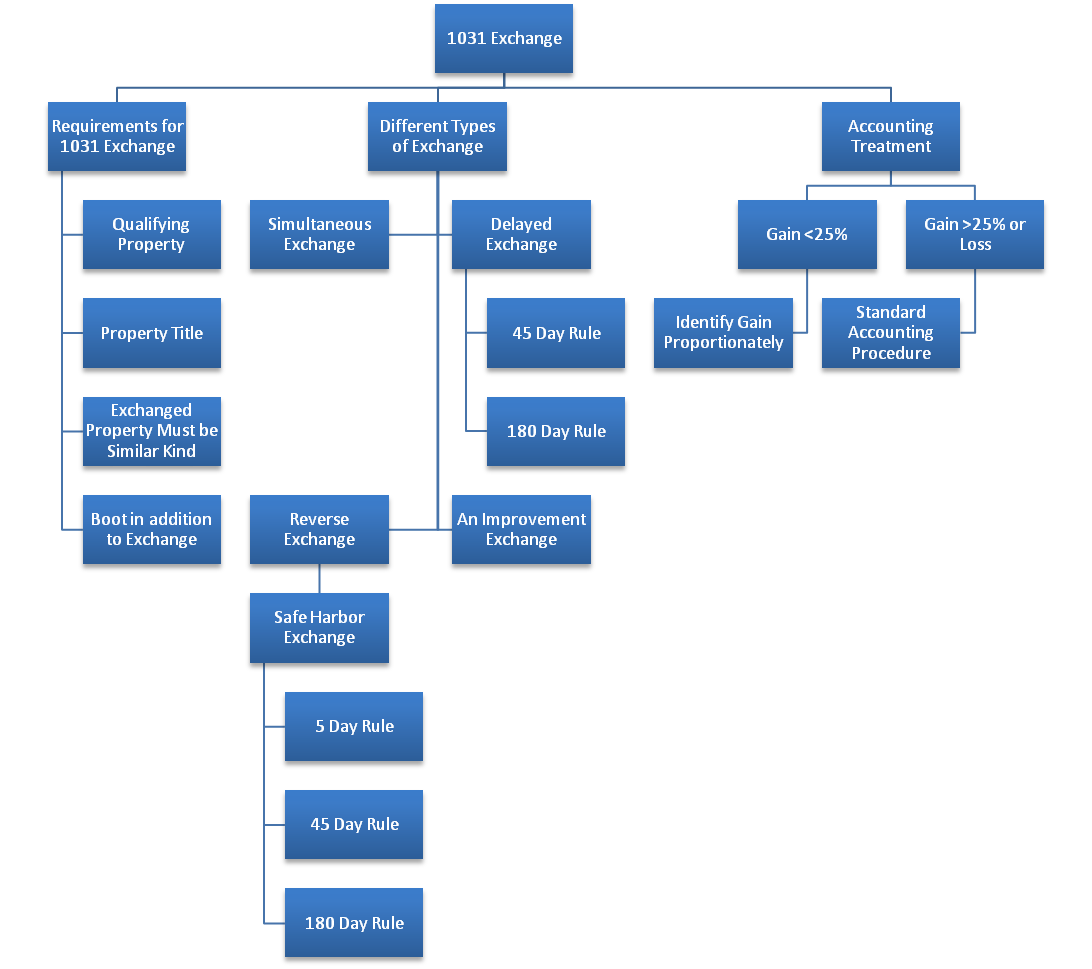

Tax Deferred Exchange has the meaning set forth in Section 108A hereof. 1031 Exchanges are complex tax planning and wealth building strategies. Also known as Like-Kind.

A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. Tax Deferred Exchange shall have the meaning set forth in. A section of the US.

Generally have to pay tax on the gain at the time of sale. Related to Tax-Deferred Exchange Documentation. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. Top 10 Reasons Real Estate Investors Are Jumping into DSTs. Its important to keep in mind though that a 1031 exchange may.

Means a series of transactions effected as part of the previous acquisition by the Borrowers of certain of the assets of Saks Incorporated. By completing an exchange.

Selecting A Qualified Intermediary For A Like Kind Exchange The Cpa Journal

Summary Note On 1031 Exchanges Rules Outsourcing Hub India

1031 Exchange When Selling A Business

1031 Exchange When Selling A Business

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

Like Kind Exchanges Of Real Property Journal Of Accountancy

The 721 Exchange Or Upreit A Simple Introduction

Mortgage Boot 1031 Exchange Guide Debt Reduction Principle

1031 Exchange Real Estate 1031 Tax Deferred Properties

1031 Exchange Rules 2021 What Is A 1031 Exchange

6 Steps To Understanding 1031 Exchange Rules Stessa

Selling A Property You Should Know About 1031 Exchanges

Identifying Property In A Tax Deferred 1031 Exchange 1031 Exchange Experts Equity Advantage

Like Kind Exchanges Are Now Clearer Journal Of Accountancy

Irs Issues New Rules For 1031 Exchanges Texas Tax Talk

1031 Exchange Rules 2022 How To Do A 1031 Exchange

1031 Exchanges Schindler Real Estate